- Choose among our BCV Fonds Stratégique asset allocation funds to find the optimal risk/return profile for your level of risk tolerance. You can invest even a small amount and earn potential gains from the most lucrative financial markets.

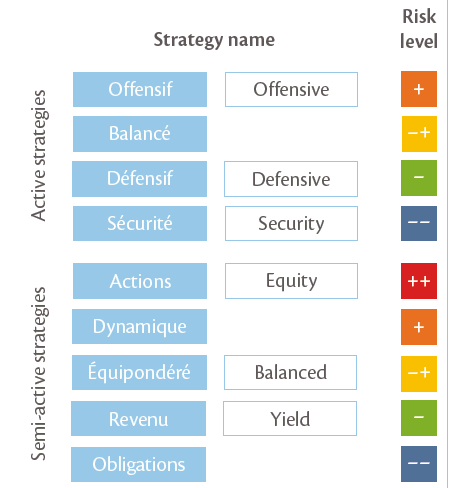

- Our eight asset allocation funds each follow a defined strategy, and your investment portfolio will be managed by our team of experts.

- Asset allocation funds are governed by Swiss federal law, and individual issuers are subject to strict regulatory oversight.

By continuing to use this website, you agree to our use of cookies to offer you personalized services and content, calculate statistics on website visits, and enable you to share content on social networks. Learn more.

Be wary if you get a phone call from someone claiming to be an IT support person. When making payments, be sure to check the payee's bank details and the amount. Your log-in details are confidential, never share them with anyone!